Augment the value of your collectibles when selling directly to your fans and get a cut out of every secondary sale.

Who we serve.

We help brands, Intellectual Property (IP) holders, and their partners enter web3 with collectibles their consumers trust. We focus on select consumer products across sports, music, entertainment, toys and luxury goods.

How it works.

Step 1: Brands send their products

Ship products in bulk to our facility

Foreign-trade-zone tax benefits

Fully managed intake and fulfillment

Step 2: We take care of the rest

Regulated custody & tokenization

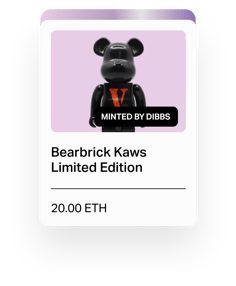

Proprietary 3D imaging & minting

All inventory is insured & audited

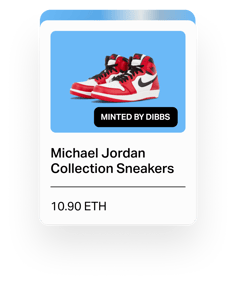

Step 3: NFTs ready for sale

Sell on any supported marketplace

Enterprise payments & accounting

24/7 brand safeguards

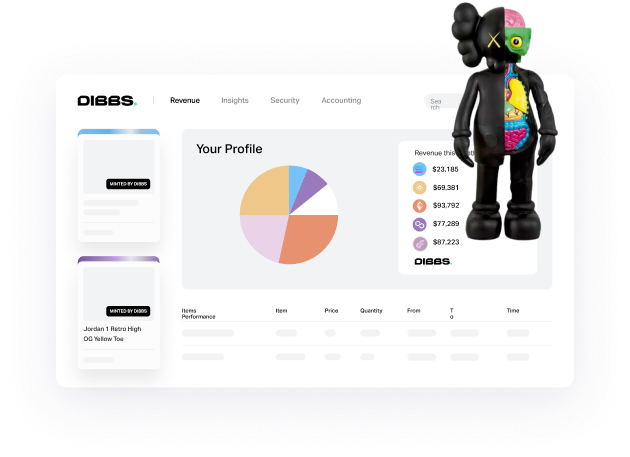

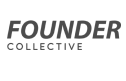

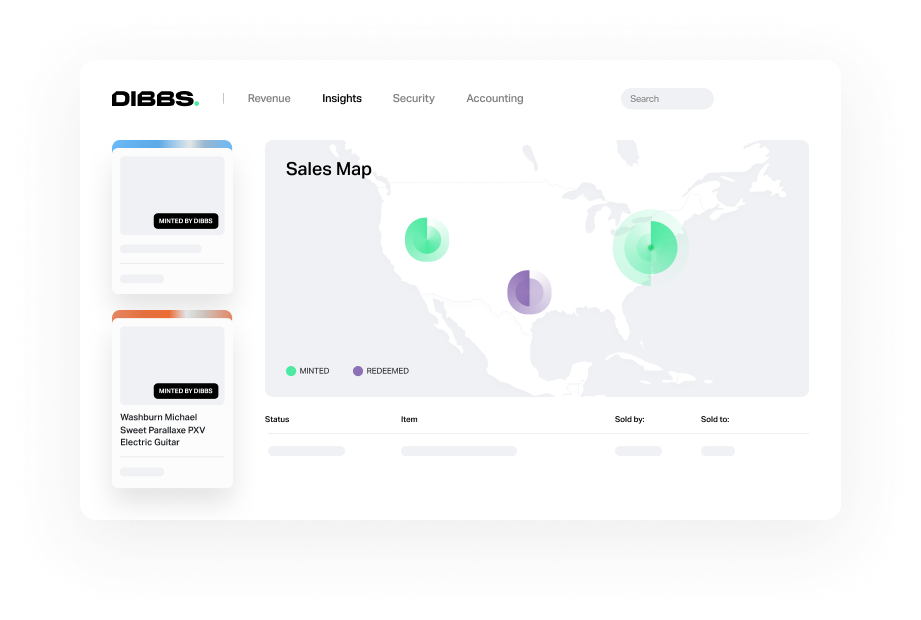

A single solution for collectibles in Web3.

Grow revenue, reduce costs and streamline your operations. We provide an end-to-end solution so your business can focus on making collectibles people love.

Secondary Market Royalties

Secondary Market Royalties New Sales Channels & Audiences

New Sales Channels & Audiences Custody, Compliance & Insurance

Custody, Compliance & Insurance

No Costly Distributors

No Costly Distributors FTZ Tax Advantages

FTZ Tax Advantages No Additional Overhead

No Additional Overhead

Brand-safe NFTs

Protect your business.

Our mission is to offer the only licensed infrastructure that allows your business to securely issue digital tokens backed by physical collectibles.

Physical-to-digital Communities

Reimagine Communities.

Empower fans to experience your products digitally, or in their homes with Dibbs' always redeemable asset-backed NFTs.

Partners we integrate with